There is no better indicator of the growth of the emerging financial technology industry than venture capital funding of fintech startups. In 2010, just under $10 billion USD was invested globally in fintech companies. Over the next decade, that number has grown 20x to just over $200 billion USD invested each year from 2020 through 2023.

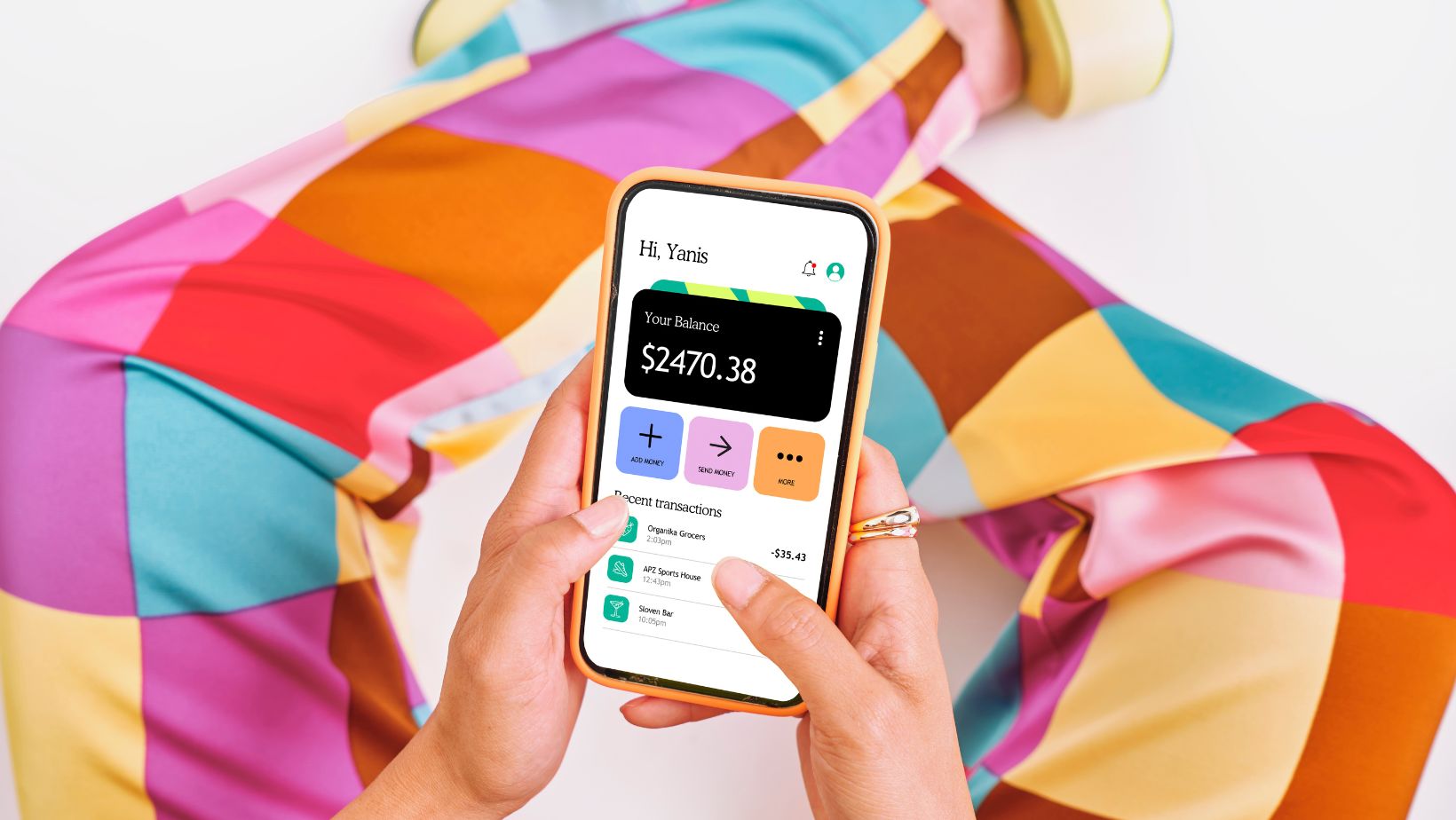

But why has fintech – a portmanteau of the words “financial” and “technology” that refers to any app, software, or technology that allows people or businesses to digitally access, manage, or gain insights into their finances or make financial transactions – experienced such dramatic growth over the last 10+ years?

As consumers have increasingly adopted digital tools, fintech arose as a means to help consumers address financial challenges and make progress toward financial goals. In turn, consumers have come to rely on fintech for a range of uses – from banking and budgeting to investments and lending – as well as for its tangible everyday benefits.

By their nature, fintech companies are often industry disruptors. They use technology to change how consumers interact with the financial industry, often filling gaps where traditional financial services companies have become inefficient or left particular groups of potential customers underserved. Fintech startups often work to expand access to financial products, lowering fees, and providing faster, more personalized service.

While a growing new trend is collaboration between fintech startups and traditional financial institutions, it’s still the nimble, bold, innovative startups that are pushing the envelope and introducing new services to new markets – and even challenging the legacy incumbents to rethink the way they approach serving their customers.

Excited to immerse myself in the innovative world of finance and technology at Fintech Islands 2024! Join the conversation and let’s shape the future of fintech together.

At Fintech Islands, we recognize the critical role that startups play in the global fintech ecosystem, including the investors that providing funding and guidance to help them build their businesses. That’s why our speaker lineup will include 50+ founders of CEOs of leading fintech startups from across the Caribbean and globally.

We’re also proud to announce the Fintech Islands Startup Pitch, a unique program to celebrate, spotlight and support founders of early-stage fintech startups with company offices in the Caribbean – or founders domiciled in the Caribbean. Our team will select 10 companies to participate. Each will receive 2 complimentary all-access passes to Fintech Islands 2024, mentorship sessions with experienced fintech investors and entrepreneurs via a partnership with The TimePledge Network, and the opportunity to pitch on the main stage in front of hundreds of global fintech leaders and our panel of celebrity investors. As the Bajan cherry 🍒 on top, three startups will also receive a non-dilutive cash award. Just follow this link to apply before the deadline.