Featured Speakers

Carmelle Cadet

Carmelle Cadet

Carmelle M. Cadet is the Founder and CEO of EMTECH, a

technology company working with central banks around the

world to make their financial infrastructures inclusive and resilient

by design. At EMTECH, Carmelle leads the vision of developing

the next generation central banking infrastructure to drive

financial inclusion, economic development and modernization of

regulatory environments. From Digital Regulatory Sandbox to

Digital Cash Platform (Central Bank Digital Currency), Carmelle

and her highly experienced team of former regulators and

experienced engineers, present groundbreaking and actionable

tech solutions to solve current economic challenges.

A thought leader and public speaker in fintech and regulatory innovation, Carmelle also advises

other women, minority fintech entrepreneurs. She has won and has been nominated for several

awards for her leadership and trailblazing work.

In her previous life, Carmelle was the Deputy CFO for IBM Blockchain where she spearheaded

the global product commercialization and financial management strategy. With clients like

Walmart, JPM Chase, Softbank, Carmelle oversaw the launch of several groundbreaking

technologies that drove better food safety, strong cybersecurity and supply chain digitization.

She joined the company as a Financial Analyst, and when Carmelle took over as Product CFO

she helped lead a highly successful product launch that created 200+ jobs while driving strong

revenue growth to over $100M in 3 years.

Carmelle earned her Executive .M.B.A. from the New York University Stern School of Business

with specializations in Leadership and Global Business, and her B.A. from Florida Atlantic

University. She is originally from Haiti, but now lives in NYC with her husband and son.

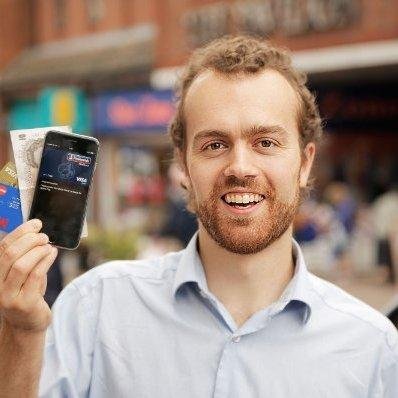

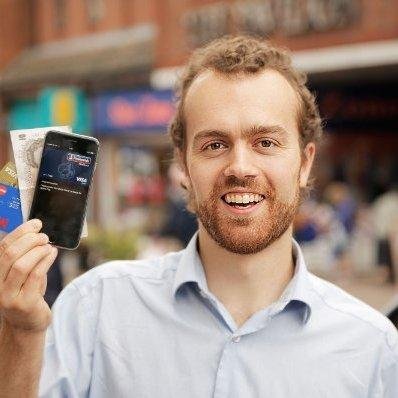

Ali Paterson

Ali Paterson

Ali is the Founder & Editor-in-Chief at FF News | Fintech Finance and creator of “The Payments Race.”

Since inception Ali has managed to grow Advertainment Media from a bootstrapped startup to a profitable company with turnover in the millions, while retaining 100% equity.

As well as shepherding bespoke video and media assets, he runs the content for Fintech Finance, interviewing some of the best and brightest representatives across the financial services landscape.

Peter Renton

Peter Renton

Peter Renton is the chairman and co-founder of Fintech Nexus (formerly known as

LendIt Fintech), a diversified media company providing essential knowledge,

connections and inspiration to the entire financial services industry. Our community

of 225,000+ banking, fintech and investment executives enjoy our diverse portfolio

of original news, newsletters, podcasts, webinars, research, credentialed education

courses, and more. Fintech Nexus is also home to the Fintech Blueprint brand.

Peter has been writing about fintech since 2010, over 2,500 articles, and he is the

author and creator of the Fintech One-on-One Podcast, the first and longest running

fintech interview series.

Peter has been interviewed by the Wall Street Journal, Bloomberg, The New York

Times, CNBC, CNN, Fortune, NPR, Fox Business News, the Financial Times and

dozens of other publications.

Sanjib Kalita

Sanjib Kalita

Sanjib has built and launched over 20 products and businesses in his career. He is Founder & CEO of Guppy, a fintech startup focused on self-sovereign credit data.

He was the Wizard and former Chief Marketing Officer at Money20/20, a fintech conference he helped grow from startup to exit. He worked for Citi, managing the world’s largest credit card portfolios, Google, creating partnerships for Google Wallet, and Intel, launching their graphics chip business.

Sanjib has an MBA from the Kellogg School of Management as well as Bachelors and Masters degrees in Electrical Engineering from Cornell University.

Theodora Lau

Theodora Lau

Theodora (Theo) Lau is the founder of Unconventional Ventures, a public speaker, and an advisor. She is the co-author of Beyond Good: How Technology is Leading a Purpose-driven Business Revolution, and host of One Vision, a podcast on fintech and innovation. Her monthly column on FinTech Futures explores the intersection of financial services, tech, and humanity. She is named one of American Banker’s Most Influential Women in FinTech in 2023. She is also a regular contributor and commentator for top industry events and publications, including BBC News, Finovate, American Banker, and Journal of Digital Banking. Her latest book, the Metaverse Economy, co-authored with Arun Krishnakumar, offers a balanced insight into the complex world of the Metaverse, and demystifies the technology and economic paradigms that have triggered the rise of the metaverse.

Dr. Terri-Karelle Reid

Dr. Terri-Karelle Reid

Dr Terri-Karelle Reid, is a human ethernet – connector of people and dots!

She has built a brand that is synonymous with the word excellence in the

world of Event and TV Hosting, Speaking, Content Curation, Online

Branding and Storytelling. Terri-Karelle is also the author of “My Brand

Compass, The 13 Cs to Building Your Personal Brand.”

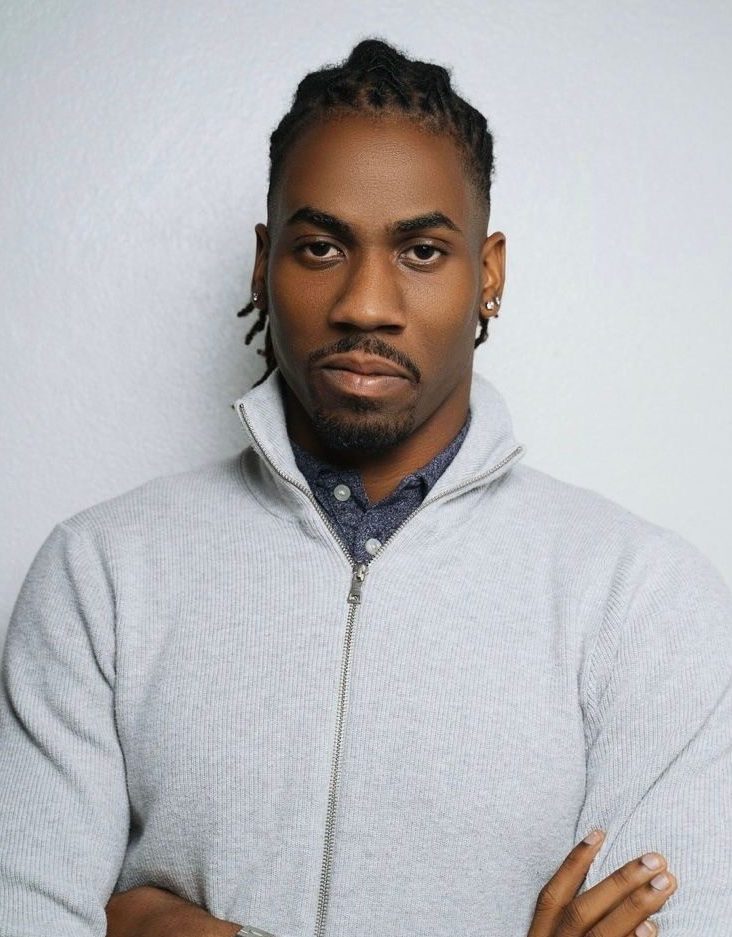

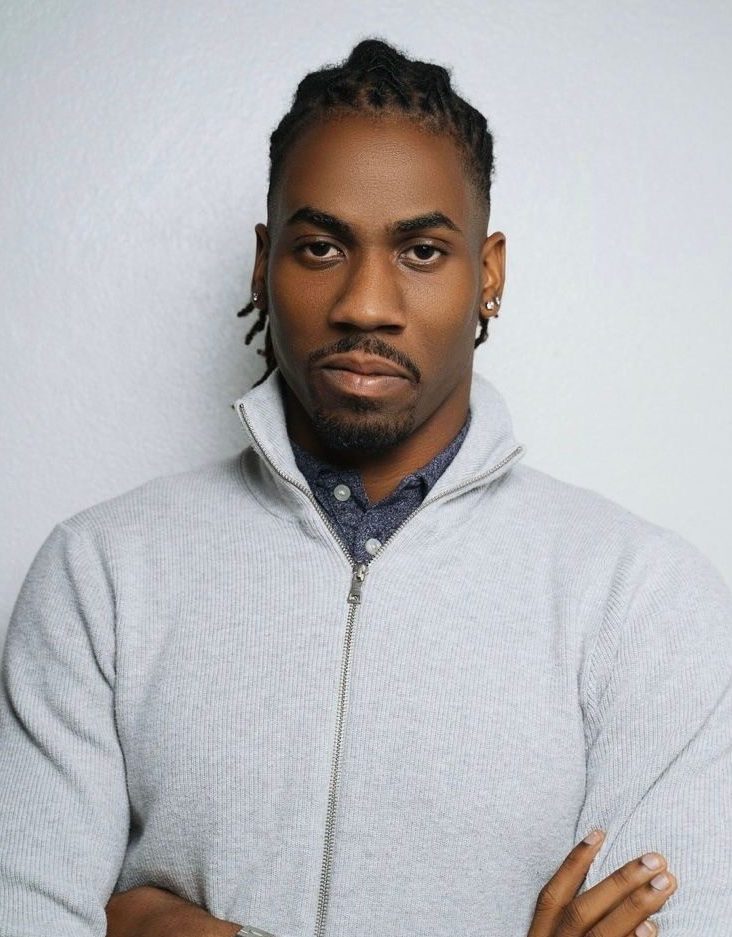

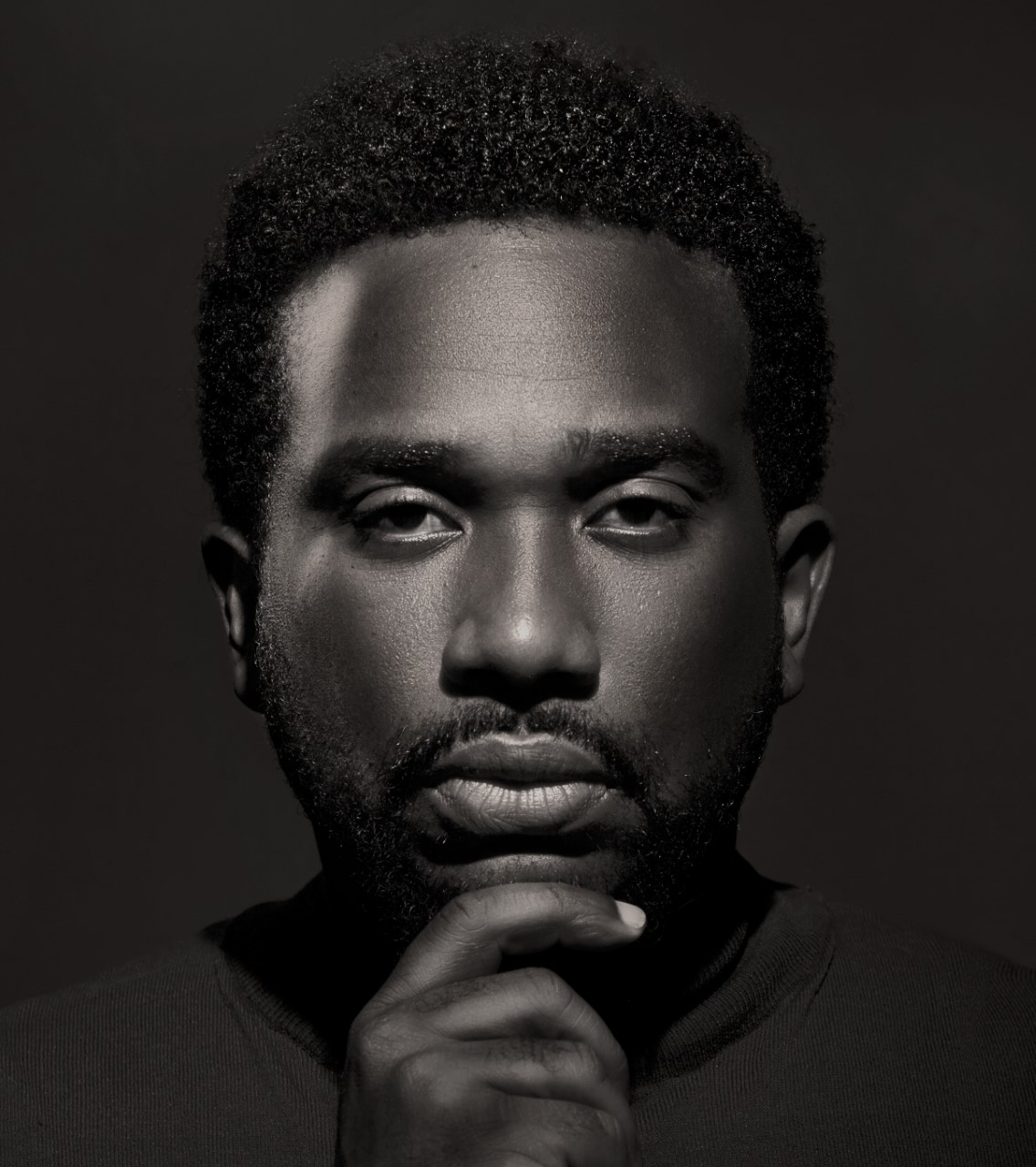

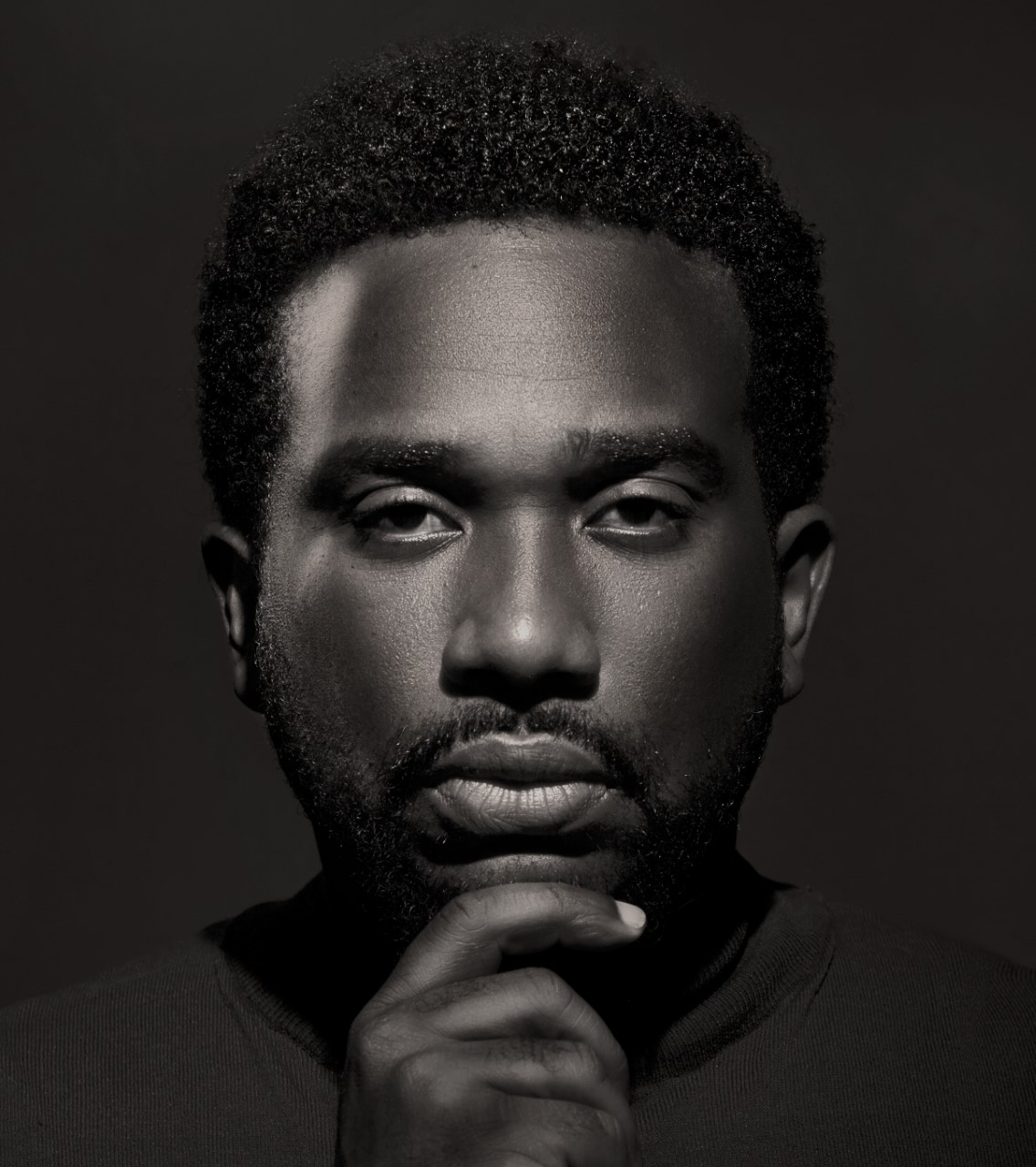

Dave Dowrich

Dave Dowrich

Dave Dowrich is Senior Executive Vice President and Chief Financial

Officer of TIAA, where he has responsibility for TIAA’s financial

management and planning, actuarial, tax, accounting and financial

reporting functions for the organization.

Dave joined TIAA from Prudential where he held a similar role for

Prudential Financial’s International Businesses, based in Tokyo, Japan.

Prior to Prudential, he worked at AIG as Chief Executive Officer,

International Life and Retirement, with oversight of AIG Life (UK), Laya

Healthcare (Ireland) and leading the Life and Retirement division’s

international strategy and growth. He previously served as CFO of AIG

Japan and Asia Pacific and as CFO and Chief Financial Actuary of

Institutional Markets in the USA. Prior to joining AIG, Dave held senior

roles in investment banking at Goldman Sachs and Credit Suisse, as

well as reinsurance and transaction structuring roles at Swiss Re and

Canada Life Reinsurance. Dave began his career as a pension

consulting actuary in Toronto, Ontario.

Dave earned an MBA in Finance from the Wharton School of the

University of Pennsylvania and a BSc in Actuarial Science and Applied

Statistics from the University of Toronto. He is a Fellow of the Society of

Actuaries, an Associate of the Canadian Institute of Actuaries and a

Member of the American Academy of Actuaries. Dave is on the board of

Scotiabank, Vantage Group Holdings Ltd, has served on several

insurance and non-insurance operating and holding company boards,

and currently serves on the boards of non-profit and academic

organizations.

In July 2022, Dave was named one of the “2022 Most Influential Black

Executives in Corporate America”

(http://savoynetwork.com/features/dave-dowrich/).

Jason Hayward

Jason Hayward

The Hon. Jason Hayward JP, MP currently serves as the Minister of Economy and Labour in the Bermuda Government. In this role, he is primarily responsible for the economic growth, development and the expansion of jobs in Bermuda. His portfolio oversees the island’s immigration, workforce development, labour relations, financial assistance, international business, statistics and economic development.

Minister Hayward was first elected as a Member of Parliament in 2019, and was later appointed as the Minister of Labour in 2020. Before becoming a Member of Parliament, he was appointed to the Bermuda Government Senate in 2017, and served as Junior Minister of Education, Health, Labour, Community Affairs and Sports. Mr. Hayward is a former Chairman of the National Training Board and chaired the Working Group which produced Bermuda’s first National Workforce Development Plan.

Prior to entering the political arena, Min. Hayward worked in the Economic and National Accounts Division of the Department of Statistics. Min. Hayward also served as the first elected full-time President of the Bermuda Public Services Union (BPSU), President of the Bermuda Trade Union Congress, and Director and Treasurer of the Bermuda Credit Union.

Min. Hayward is an alumnus of the Canada – Caribbean Emerging Leaders Dialogue (a Commonwealth leadership development program), an alumnus of the US Department of States’ International Visitor Leadership Program, and holds a Chartered Manager Designation from the Chartered Management Institute.

Minister Hayward holds a MBA in Finance from Nova Southeastern University, a Bachelor’s degree in Business Administration from Mount Saint Vincent University and an Associate’s degree in Arts and Science from the Bermuda College

Christopher Kai

Christopher Kai

Forbes “International Speaker” and Inc.’s “Billionaire Networker” Christopher Kai is a 7X author, founder of GPS, a speaker training program and founder of GifterX Talks, the world’s leading speaker community for entrepreneurs which has been called the “TED Talks for Entrepreneurs.” He is a former American Express business strategist. He teaches entrepreneurs how to build a global personal brand, master networking, and become a professional speaker. Christopher has helped his clients in 120 cities and 30 countries generate $200 million. He is the author of “Wizard of Words: The 7 Magical Words for Success,” “Story-based Leadership: How 2 Rise 2 the Top with Your Story” and “Big Game Hunting: Networking with Billionaires, Executives and Celebrities” which is a #1 international bestseller. Outside of his business, he created Mondays at the Mission, the only homeless youth program of its kind in the world. Elon Musk once exclaimed in an interview, “Wow! You really know a lot!

Peter Hazlehurst

Peter Hazlehurst

Peter Hazlehurst, CEO and co-founder of Synctera, is a global FinTech entrepreneur and philanthropist with nearly 30 years of experience creating financial products for banks, FinTechs, and large tech companies.

In 1993 he built core banking technology for Phoenix, which still powers companies today. More recently, Peter served as Head of Uber Money, Chief Operating Officer at Postmates, Senior Director of Product Management at Google, CEO and Board Member of Google Payments Corporation, and Chief Product Officer at Yodlee.

Peter also led Product at Nokia for Enterprise Mobility and Mobile email and has served as a CTO and consultant at several startups.

Kadeen Mairs

Kadeen Mairs

Kadeen Mairs is a Jamaican businessman, investor and philanthropist. He is currently CEO and Founder of Dequity Capital, a privately held investment Company with Assets under management exceeding J$3 billion. Dequity owns a collection of businesses in different industries including financial services, healthcare, technology and Real estate. Kadeen is widely regarded as a visionary entrepreneur and strategist whose philosophy of “solving problems and creating businesses with the solutions” has resulted in extraordinary business success and becoming one of Jamaica’s youngest self-made billionaires. Kadeen has over 16 years of experience in the financial sector, starting at 18 working within Credit Unions, Commercial Banks, Investment Banks, Venture Capital Companies and the Founding of Micro Finance Company Dolla Financial Services and listing it on the Jamaica stock exchange with one of the largest oversubscriptions in the history of the Junior Market. Among his many personal accomplishments, Kadeen holds a BSc in Business Administration. He is also a Certified Expert in Micro Finance from Frankfurt School of Finance & Management, Germany and holds an Executive Certificate in Private Equity and Venture Capital from Harvard Business School. Kadeen is a member of the Forbes Business Council and was awarded Young Entrepreneur of the Year 2022 by the Montego Bay Chamber of Commerce. In 2023 Kadeen Adopted the Grange Hill Health Centre in his hometown and donated $5 million.

Rohan Marley

Rohan Marley

Rohan Marley is an entrepreneur and former football player for the University of Miami Hurricanes and Canadian Professional Football League. He is the son of reggae legend and humanitarian, Bob Marley.

Rohan founded Marley Coffee, an organic coffee plantation and sustainable farming business sourced from Jamaica’s Blue Mountains and Ethiopia with coffee shops in operation worldwide. Later he founded House of Marley, an eco-friendly headphones and speakers electronics company. The brand can be found worldwide throughout all major electronic stores.

Rohan helps run his family’s charitable organization 1Love, as well as, Tuff Gong Clothing company.

Another venture by Rohan is the RoMarley Beach House in Puerto Morales, which opened in July 2020 in partnership with The Fives Oceanfront, a luxury boutique hotel.

In 2022, Rohan launched Lion Order, a Rastafari cannabis and hemp lifestyle brand. Lion Order is currently sold in Michigan with plans for expansion throughout all U.S. and international recreational and medical markets.

Paolo Narciso

Paolo Narciso

Paolo Narciso, an accomplished author and social entrepreneur, is renowned for his contributions to the non-profit and technology sectors. He is the author of “NFTs for Business: A Practical Guide for Harnessing Digital Assets,” a pivotal work that explores the use of digital assets in contemporary business practices, available on Amazon and SpringerLink.

As the Vice President of New Program Development and Program Optimization at AARP Foundation, Paolo is pivotal in developing solutions to improve the lives of vulnerable older adults. He oversees initiatives that create new economic opportunities, financial inclusion and foster social connections. The solutions he deployed integrated disruptive technologies like Web3, and VoiceAi into the products used by older adults living with low income.

His entrepreneurial journey includes co-founding CloudHealth Asia (now Global Medical Technologies), providing critical primary care access in Southeast Asia. A serial tech entrepreneur, Paolo has led multiple startups to successful exits and demonstrates a profound commitment to leveraging technology for social good.

Paolo holds a Doctorate from Creighton University, awarded in 2016, underlining his interest in research and academia alongside his practical achievements in technology and social entrepreneurship.

Paul Pirie

Paul Pirie

Paul is the CEO of TCI Finance, working with the Government and Private Sector to promote the Financial Services industry in TCI. With an honours degree in Law and a Masters in Corporate Finance, Paul has over 20 years’ experience in Investment Banking and Consultancy.

Before joining TCI Finance, Paul was a Director at JP Morgan leading their Digital Asset strategy across Trading Services, and prior to that led transformational projects around the globe for PWC´s Advisory group. Paul is a keen believer in an “Innovative and Agile approach to change”.

Originally from the UK, Paul has spent most of his career overseas in Luxembourg, South Africa, Canada, Singapore, and the United States.

Richard Powell

Richard Powell

Richard Powell’s story is an inspiration. Born in Spanish Town, Jamaica, he excelled as a teenager in both academics and athletics. After playing soccer for Jamaica at the U17 and U20 level, and considering an opportunity to play professionally in Europe, Richard ultimately decided to study economics at Harvard University, where he represented the school in soccer and track & field, and founded his first company while still an undergraduate.

Now, with over two decades of experience in corporate finance, governance, business development, and principal investing in private and public companies, Richard is a seasoned entrepreneur and investor who has co-founded and led multiple successful ventures. Two of these were scaled to billion-dollar enterprises, these were: Zerochaos, a global HR BPO that grew to 12,000 employees globally and $1.2 billion in revenues at exit, and most recently Project Black at Ariel Alternatives, a $1.4 billion private equity platform that aims to create the next generation of large, global, diverse suppliers to the Fortune 500.

Richard is currently the Chairman of Sequential Technologies International, a global BPO headquartered in the USA, APC Holdings, a 20-year-old investment firm that partners with institutional investors and business owners to build lasting companies with measurable social impact, and The RMP Group, his family office. He is a YPO member and a Young Global Leader at the World Economic Forum. Perhaps most timely, he is currently putting together an innovative vehicle to invest over $2.0 billion of capital, with the flexibility to deploy in the US and Caribbean region, to address the demand in private equity, private credit, real estate and infrastructure assets.

Nicholas Rees

Nicholas Rees

Nicholas Rees is a two-time Olympian, FinTech visionary, and entrepreneur born on the Island of Grand Bahama. Nicholas serves as Chairman and Co-founder of Kanoo Pays (“Kanoo”), the World’s First licensed Payment Institution to achieve integration, interoperability, and processing of secure Central Bank Digital Currency (“CBDC”) payments.

Kanoo has now grown to become the Caribbean’s leading “Super App,” offering an integrated digital marketplace and wallet experience. Nicholas’ vision for Kanoo is to provide true financial inclusion and empowerment by connecting the people and businesses of the Caribbean through technology.

Nicholas believes in a humanistic, people-first approach to deploying technology solutions and aims to empower people to prosper. Nicholas is committed to delivering on the Kanoo promise of Security, Prosperity, Empowerment, and Convenience.

Nicholas is a Chartered Certified Accountant (ACCA) with a Master of Business Administration from The University of Miami. Nicholas is also an alumnus of The Ohio State University, having graduated in 2003 with a bachelor’s degree in Financial Management and a Minor in Economics.

Matteo Rizzi

Matteo Rizzi

Matteo Rizzi is an unconventional entrepreneur with two decades of experience in Financial Services, constantly referred amongst the top executives in the industry.

He spent 13 years at SWIFT – where he co-founded Innotribe, the innovation arm of the cooperative, launching the first global startup challenge. Since 2013, he has a FinTech Investor and/or Venture Partner role with global VCs and CVCs (20+ deals, 5 exits). In 2015, he co-founded FinTechStage (now FTSGroup.eu) – a platform for Investors and Innovators to boost FinTech innovation globally. In 2019, Matteo founded Timepledge.org, a global initiative to foster financial inclusion and entrepreneurship. The same year he launched Breaking Banks Europe (as the Executive Producer).

He is the author of “The FinTech Revolution” and “Talents & Rebels” and is fluent in 5 languages.

Hon. E. Jay Saunders

Hon. E. Jay Saunders

Hon. E. Jay Saunders is the Deputy Premier and Minister of Finance, Investment & Trade of the Turks & Caicos Islands (TCI). Since becoming the Minister of Finance, the TCI has seen a significant uptick in annual revenues, reaching a record US$413.2M in FY2022/23.

Hon. Saunders’ impact has also been felt in the health sector. From February to July 2021, he served as the Ministry of Health & Human Services. His leadership was instrumental in reducing the islands’ active COVID-19 cases from approximately 400 to 0.

Hon. Saunders is a member of the National Security Council, contributing to vital decisions on external affairs, defense, and internal security.

Outside of politics, Hon. Saunders founded DSS, the maker of the award-winning SafetyNet.ai, which aids financial organizations in complying with Anti-Money Laundering (AML) and Know Your Client (KYC) rules and regulations. Hon. Saunders also co-founded Digicel TCI where he served as CEO from 2006-2014.

Diego Szteinhendler

Diego Szteinhendler

Diego Szteinhendler is Senior Vice President of Fintechs, Enablers and Crypto for Latin America and the Caribbean. In this role, he and his team are responsible for the strategy, relationship, and growth of the fintech ecosystem in the region.

Diego joined Mastercard in 2008, and since then, has held roles in different areas of the organization and geographies. In his most recent role, he led business development for Mastercard’s fast growing Cyber & Intelligence business in North America, where he partnered with established companies and startups to improve and optimize their fraud, cybersecurity, artificial intelligence, authentication, biometrics, chargebacks, crypto AML and other key operational functions.

Throughout his career, Diego also led product management and business development at industry leading companies like Discover and PayPal as well as in start-ups including, Transpay and CheckWow.

Diego holds an M.B.A. from the University of Texas at Austin and is a graduate of the Digital Transformation program at Columbia.

He is an avid traveler having visited 75 countries.

Mikel Thomas

Mikel Thomas

Mikel is a 3x Olympian from Trinidad and Tobago, the first athlete from the region to qualify for both the Summer (110m hurdles; Beijing 08, London 12, Rio 16) and Winter Olympics (2 man Bobsleigh-Beijing 2022).

With an impressive track record of driving innovation and execution within large global organizations, his skills have consistently enhanced the performance of the teams he’s worked with.

Currently, Mikel supports Visa’s Global & North American Fintech Partnerships driving growth and development of fintech wealth management platforms, as well as Visa’s Inclusive Client Partnerships focused on innovating relationships and amplifying impact of underrepresented founders (Black, Brown, Latinx, LGBTQ, Indigenous and women founders) within the fintech space in North America.

Prior to joining Visa, an experienced storyteller and marketer, Mikel worked with brands like Airbnb, Brooks and JBL, to global organization like the International Testing Agency(ITA) and the International Olympic Committee(IOC).

Mikel has also spent time serving his community as a former Firefighter/EMT in Atlanta metro area in Clayton County.

He gained his Master’s degree in Sport Management and Technology from the International Academy of Sport Science and Technology (AISTS) in Lausanne, Switzerland, Bachelors in Kinesiology from the University of Kentucky.

Carol Grunberg

Carol Grunberg

Carol spearheads global payments, partnerships and commerce innovation, holding executive roles at Citi, Northwestern Mutual, Ant Group, and Google. Integral in developing super apps and unified commerce, she excels in emerging markets and the US-Asia tech sector.

Driven by a passion for fintech and social impact, Carol leads advancements in AI, commerce, and payment technologies. She is a vocal advocate for women in business and dedicates herself to community development. As a TeamUnity board member, Carol focuses on enhancing social health factors in Harlem, NY.

All Speakers

John Akumalla

John is a Senior Manager in Technology Consulting for KPMG Caricom. He is also the KPMG Caricom Alliance lead for Microsoft and sub-sector driver for Governments. John has over 10 years of experience in consulting in Strategy and Transformation Engagements across Government, Healthcare, Telecom, Manufacturing, EdTech, Oil & Gas, FMCG, Hospitality Industry, and B&FS sectors. His areas of expertise include Business Development, IT / Digital Strategy and roadmap, Business Intelligence, Digital Transformation – Program Management.

Juan Zavala Aleman

Ex-Mastercard | Latitud Fellow LF3 | Forbes 30 – 2022

Passionate about innovation and startup investment in Latin America. Experienced with 13+ years of knowledge in Payments, Fintech, Startups, Financial Institutions and Consumer Goods in Latin American markets.

Strong experience in business development, team management, finance management, international account management, sales strategy, and international sales.

LGBTQ+ & diversity leader and promoter

Martin Kwame Awagah

Martin Kwame Awagah is a highly experienced Digital Economy Specialist and FinTech Expert with over 12 years of expertise in economic research, governance, public policy, financial inclusion, international development, and project management. He is recognized for his contributions to the advancement of financial technologies (fintechs) and digital/mobile payment institutions in Ghana. Martin holds key leadership positions and plays a pivotal role in promoting financial technology innovation, knowledge sharing, and capacity building within the fintech ecosystem.

Dr. Annalee C. Babb

Barbadian Dr. Annalee C. Babb is CEO of Intersections, a start-up cluster driver helping to accelerate Caribbean creativity and innovation. She explores these issues in the My Belonging podcast (https://www.intersections.digital/mybelonging/). She was Digital Transformation Sherpa | Ministry of Foreign Affairs & Foreign Trade, and the Prime Minister’s Special Envoy | Special Advisor | Ministry of Innovation, Science & Smart Technology. She led the team developing COVID-19 public health emergency management tech solutions; was legislative co-Chair for Barbados’ national digital ID | mobile ID; led on creation of a tech accelerator for digital public services; and chaired the Telecoms Working Group. She led the Digital Transformation and Solutions Committee | Prime Minister’s Jobs and Investment Council, was a member of the Queen Elizabeth Hospital Board, co-lead organiser of UNCTAD 15’s Creative Industries Trade Digitisation Forum, and on the International Advisory Board of Oman’s Research Council.

Sarah Bailey

Sarah Bailey is the Head of Programme for the World Food Programme Multi-Country Office for the Caribbean. She brings 18 years of experience in the humanitarian and development sector. Prior to joining WFP, she was an independent consultant and worked with the think tank the Overseas Development Institute in London. Sarah holds a Masters of Law and Diplomacy from the Fletcher School at Tufts University.

Haifa Ben Salem

Originally from Tunisia and currently based in Geneva, Haifa Ben Salem works at the International Trade Centre – United Nations – Tech Sector Development team on projects supporting the Tech sector at different levels in more than 12 markets in Africa, Asia and The Caribbean.

Her work involves capacity building of Tech startups, enabling ecosystems, connecting digital entrepreneurs to market opportunities and investment, strengthening online freelancers’ skills & promoting job creation through tech entrepreneurship and innovation.

Annie Bertrand

Annie is an international development consultant with a Harvard MBA and 20 years of management consulting, entrepreneurial, and volunteering experience in over 50 countries. After four years at the Inter-American Development Bank leading a multi-million portfolio of private sector projects, she worked for several agencies to drive digital transformation and resilience in the region. She is currently working for the United Nations Capital Development Fund (UNCDF) on improving access to digital financial services in the Caribbean, and for a consortium of tourism organisations on necessary approaches to inclusive and sustainable development in Small Island Development States (SIDS). Annie began her career in 2001 at Deloitte in Montréal as a Certified Management Accountant (CMA) and moved to Barbados in 2006. She loves boxing, health and craziness!

Michelle Beyo

Michelle Beyo is the CEO of FINAVATOR, an award-winning future of finance consultancy. She is also a TEDx Speaker, WEDO United Nations speaker, Money 20/20 Rise Up alumni, board advisor to Open Banking Expo and the President and a Board Member at the Open Finance Network of Canada (OFNC).

With over 20 years of extensive industry experience, Michelle started FINAVATOR as she is passionate about payments and financial inclusion. She has helped to drive innovation across the retail and payments space and supported the growth of industry leaders across North America.

Michelle Beyo has won multiple awards including the “Top 30 Best CEOs in 2021” by The Silicon Valley Review, “Women in Fintech Global Powerlist” 2021, “Most Influential Leader in FinTech Consulting 2020 – Canada” by Corporate Vision.

Chad Blackman

Senator Blackman is the Minister in the Ministry of Economic Affairs and Investment of Barbados. With over twenty years of experience in international development, he possesses tremendous insight to the myriad of challenges and opportunities faced by countries in the Global South.

Minister Blackman previously served as a Consultant in Youth Development at the Commonwealth Secretariat in London, as well as a Partner in St. Lucia-based law firm with a specialization in international trade and data protection law.

He served as Barbados’ Ambassador to the United Nations at Geneva, Vienna and Rome, as well as Ambassador to Switzerland, Austria, Hungary and Serbia. During his tenure, he served in various committees in the WTO, UNCTAD, including Chair of the Trade and Environment Committee, and Trade and Development Committee of the WTO, the President of the G77 and China in Geneva, as well as on the Global Board of the UN International Gender Champions.

He later joined the International Labour Organization (ILO) as Senior Advisor to the Director-General with responsibility in Cabinet for Latin America & The Caribbean, Africa and Arab States; External Relations; Legal Affairs, the ILO’s Tribunal and Corporate Services.

Minister Blackman has both the LLB Law and LLM International Trade Law from the University of Essex in the United Kingdom and is an Associate Member of the London-based Chartered Institute of Arbitrators.

Aaron Bumgarner

Aaron is a proud North Carolina native and grew up on the family farm in the mountains of North Carolina. Aaron has over 20 years of experience in designing and implementing projects focused on forest management for wildlife in Virginia and North Carolina for private landowners.

The past several years, Aaron has been focused on leading Outsyde, Inc. a company focused on conservation land acquisitions, climate tech, outdoor recreation, renewable energy, blockchain, digital assets, public capital markets and carbon market strategies.

Aaron is a graduate of Lenoir Rhyne College in Hickory, NC and holds a degree in Business Marketing and Finance. Aaron splits his time between Richmond VA and Emerald Isle, NC with his wife, daughter and his Foxhound sidekick “Molly”.

Christopher Burns

Chris Burns is the CEO of First Atlantic Commerce. He has worked in the ecommerce industry for 19 years and has served as CEO of FAC for the past 10 years. His expertise lies in assisting companies and banks develop and deploy successful ecommerce strategies across the Latin America and Caribbean region. Today FAC is operating in 29 countries, processing hundreds of millions of dollars a year, and it is the most connected payment gateway in the Caribbean and Central America with team members in five countries. FAC’s clients include Flow, Digicel, Pricesmart, Sandals, and many of the region’s governments and major utilities. Chris is also CEO of Powertranz, a sister company to FAC. Powertranz was recently started to address many of the inadequacies in the Point of Sale industry in the Caribbean.

Carmelle Cadet

Carmelle M. Cadet is the Founder and CEO of EMTECH, a

technology company working with central banks around the

world to make their financial infrastructures inclusive and resilient

by design. At EMTECH, Carmelle leads the vision of developing

the next generation central banking infrastructure to drive

financial inclusion, economic development and modernization of

regulatory environments. From Digital Regulatory Sandbox to

Digital Cash Platform (Central Bank Digital Currency), Carmelle

and her highly experienced team of former regulators and

experienced engineers, present groundbreaking and actionable

tech solutions to solve current economic challenges.

A thought leader and public speaker in fintech and regulatory innovation, Carmelle also advises

other women, minority fintech entrepreneurs. She has won and has been nominated for several

awards for her leadership and trailblazing work.

In her previous life, Carmelle was the Deputy CFO for IBM Blockchain where she spearheaded

the global product commercialization and financial management strategy. With clients like

Walmart, JPM Chase, Softbank, Carmelle oversaw the launch of several groundbreaking

technologies that drove better food safety, strong cybersecurity and supply chain digitization.

She joined the company as a Financial Analyst, and when Carmelle took over as Product CFO

she helped lead a highly successful product launch that created 200+ jobs while driving strong

revenue growth to over $100M in 3 years.

Carmelle earned her Executive .M.B.A. from the New York University Stern School of Business

with specializations in Leadership and Global Business, and her B.A. from Florida Atlantic

University. She is originally from Haiti, but now lives in NYC with her husband and son.

Jasmine Chai

Jasmine Chai is a seasoned Executive Consultant with over 20 years of experience in delivering impactful ERP and CRM solutions that transform businesses in various industries. She is passionate about driving organizational excellence through innovative technology solutions. Jasmine and her team at IBM Microsoft practice foster a culture of collaborative synergy, open communication, and a strategic mindset to successfully attain project objectives. She excels in building lasting client relationships by understanding their unique challenges and aligning Microsoft Business Application technology solutions with their business goals. Her commitment to client satisfaction has resulted in a strong track record of repeat business and referrals.

Jehan Chreiki

Jehan Chreiki (nee Jardine) is passionate about highlighting the potential of the people from the Caribbean. As a Trinidad native and adopted St Lucian, she loves all things quintessentially Caribbean and believes that we have a wellspring of talent.

While attaining a BSc. Communications in PR & Advertising at Endicott College, Jehan completed month and semester-long internships at a Community Development Program in the South End of Boston. An advertising internship at McCann Erickson and at a Literary PR firm where she worked on the publicizing of Madeline Albright’s autobiography. With those experiences fueling her she moved to London to pursue a career in Consultancy where she worked with FTSE 200 listed businesses, Boutique firms and Startups.

The call to home came in 2010, Jehan returned to Trinidad and spent a decade as an Operations Director at a family-owned and led SME Logistics Company. During that time she represented T&T on the Caribbean stage of Shipping as an elected member of the state board, T&T Shipping Association where she served multiple terms.

Upon relocating to St. Lucia to start a family Jehan took the time to figure out how to bring her passion to life. Having always had a yearning to elevate the region beyond beautiful beaches and parties came a vision to create a skill exchange platform that could give people opportunities beyond their borders and financial means. Jehan then Co-founded Bandy, a Caribbean digital time banking App that will foster social mobility, strengthen economies and enhance communities.

Anthony Clerk

Anthony Clerk, Managing Director and Chief Executive Officer, Republic Bank (Barbados) Limited, was appointed to the Board of Republic Bank (Barbados) Limited in 2017. Mr. Clerk is a career banker with more than a decade of experience at the Senior Management Level and has served as Regional Corporate Manager, Corporate Business Centre East/Central, Republic Bank Limited; General Manager, Credit, Republic Bank (Grenada) Limited; Corporate Manager, Corporate Business Centre North, Republic Bank Limited; and Branch Sales Manager, Ellerslie Court, Republic Bank Limited.

Mr. Clerk holds an Executive MBA and a Diploma in Business Management, both from the Arthur Lok Jack Graduate School of Business, and a Diploma in Banking from the Institute of Banking and Finance of Trinidad and Tobago. He is a pass council member of the Barbados Chamber of Commerce and Industry. He has served as a Non-Executive Director on the Board of National Enterprises Limited. Mr. Clerk is currently the President of The Barbados Bankers Association.

Stevon Darling

Stevon D. Darling is the co-founder of Onest, a technology company focused on providing responsible financial products to the 80 million people living across the Caribbean and Central America. Onest uses alternative data to provide personalized credit to underbanked segments while simultaneously using behavioral science to help consumers develop healthier financial habits. The company’s long-term vision is to enhance all aspects of how consumers engage with money, providing them with better ways to save, spend, and earn additional income. He is the former Chief Investment Officer of H20 Capital where he was a member of the investment committee, led the firm’s Mexican operations, and built their fintech strategy. He also has prior experience at the World Bank, where he developed several financial inclusion projects and led IFC’s venture capital strategy across Latin America. He started his career as an investment banker with Goldman Sachs in New York City. Stevon, who is originally from The Bahamas, holds a Master of Business Administration from Harvard Business School and a Bachelor of Arts in Accounting from Morehouse College where he graduated Phi Beta Kappa and summa cum laude.

Ian De Souza

Mr. Ian De Souza, a career banker with over 35 years of progressive banking experience, has recently been appointed Managing Director, ANSA Merchant Bank, Trinidad & Tobago. Before this, he retired from the Republic Bank Group in 2017, where he was an Executive Director and Managing Director of Republic Bank (Barbados) Limited. Further, he held the executive positions of General Manager – Risk Management, General Manager – Corporate & Investment Banking, President – Republic Bank (DR) S.A. in the Dominican Republic and Managing Director – Republic Finance & Merchant Bank Limited (FINCOR).

Following his retirement from Republic Bank, Mr. De Souza joined the University of the West Indies, Cave Hill, Barbados, in the capacities of Executive Director and CEO of the Cave Hill School of Business and Management. He was also appointed Professor of Practice, Banking and Finance, in the Department of Management Studies.

Mr. De Souza later established Advice Financial Co. Ltd, an advisory practice specializing in corporate finance, debt management and corporate turnarounds. As Consultant and Project Lead, he successfully led Republic Bank’s acquisition of Scotiabank’s operations in the Eastern Caribbean, St. Maarten and the British Virgin Islands. He also completed the restructuring and reorganization of CAPITA Financial Services Inc.

Mr. De Souza holds a BSc. Economics, a Post-Graduate Diploma in Management and an Executive MBA from the University of the West Indies, St. Augustine. He is a Chartered Professional Accountant, a Certified Insolvency and Restructuring Advisor, and is certified in Forensic Accounting and Fraud Examination. He is also an alumnus of the Harvard Business School Advanced Management Programme.

Héctor Deambrosi de León

“Mr. Deambrosi joined Infocorp in 2013 to lead and strengthen the Business Development team, with an initial assignment to Central America and Colombia as Regional Manager. After a very successful period, he was appointed to become the Latam Head of Sales and Alliances since 2020.

Experienced General Manager and International Sales and marketing Director with a proven record of achievements and success in developing Business and new territories in Mexico, South America and The Caribbean. Academic degrees in Engineering, International Economics and Executive Direction. Solid skills in Management, Strategic Planning, Organizational Development, Negotiation and Leadership. Devoted builder of synergic interpersonal relations, coaching and competitive advantages. Fluent in English, German, Spanish and Portuguese.”

Icelsa Diaz

With over 15 years of experience spanning industries like Telecommunications, Manufacturing, Insurance, and Digital Banking for financial services in the Caribbean, she excels as a Business Development head and strategist driving the growth of the Fintech and Digital partners ecosystem in the region.

Icelsa is renowned as one of Fintech America’s Top 25 most innovative bankers and holds the esteemed title of Top 50 Women of Power and Success in the Dominican Republic.

She actively contributes to fintech organizations and accelerator entities across the Caribbean, showcasing her expertise as an Industrial Engineer with an MBA from Université du Québec à Montréal and a master’s in digital marketing and business from the University of California.

Carlo DiPucchi

With over 25+ years of experience organizing and implementing multiple business applications with the last 18 years in Microsoft systems around Dynamics 365, M365, and Power Platform, Carlo is well-positioned to provide advice and planning in the direction of technology and software delivery solutions. He has successfully managed more than 60 ERP & CRM projects from small to multi-year – multi-country implementations.

As the Associate Partner and Delivery Executive for the Microsoft Dynamics product lines, he is responsible for providing advice on the management of consulting, development, and administrative staff within Microsoft Dynamics implementation projects. He also oversees and advises on scoping and determining the client processes, determining best practices, and providing overarching governance. With a finance background have spent many years implementing solutions in the financial services sector from payment workflow, procurement processing, analytics and AI to digital transformation.

Adil Dirie

“Adil is deeply immersed in the realm of financial inclusion within Low- and Middle-Income countries as a member of the GSMA’s Mobile Money Programme.

His primary role involves nurturing cooperation among stakeholders within the industry, with the objective of addressing pivotal challenges and seizing opportunities in the digital finance landscape.

Adil’s focus centers on unlocking the potential of digital technology to uplift marginalized communities, driven by his unwavering belief in technology’s transformative capabilities.

Drawing from his previous experience as a business developer in the digital cross-border money transfer sector, Adil possesses a unique understanding of the sector’s intricate workings.

His wealth of expertise and unwavering commitment position him to speak on the remarkable potential of digital technology in the realm of financial inclusion”.

Keith Downer

A forward-thinking strategic and tactical executive, I earned an MBA from Columbia University and a BSc. In Computer Science and Mathematics Magna Cum Laude from UWI in Barbados. I served as the Head of Risk Architecture Reporting to the CRO of CCB at JPMorganChase and led the ERM Capabilities at Citi Globally and lead the Risk and Business Capabilities for American Express Interactive. I have 32 years of experience in Risk, Finance, Data, Analytics and Emerging Tech, and international experience across ASIA, Europe, Latin America and the Caribbean. I have also been actively involved in Blockchain and Cryptocurrencies since 2016 where I supported a client project to evaluate the BlockChain technology, design and implementation of Blockchain architecture for internal and external contracts with trading partners. The pilot was then implemented for business use. I continue to provide assistance to clients on their white papers, business plans and Risk profiles and evaluates for clients the Risks to be considered. I have presented on Risk Management, AML, KYC, Fraud, Customer Onboarding, AI, Blockchain and Big Data at industry conferences and events such as the Blockchain Fest @Boston hosted at MIT, the Blockchain Leadership Connect Consensus New York 2018, the Chicago 2018 Blockchain Leadership connect and was a Blockchain Hackathon judge at the Global Blockchain Hackathon in New York in July 2018 and the Global Blockchain Hackathon in Chicago 2018. I am currently performing as the COO of TechBlue, which provides Data Analytics, Robotic Process Automation (RPA) and visualization solutions that optimize operational performance in both the public and private sector. I am a Co-Founder of VENTI – a mobile digital wallet and debit card account, that allows for for the real time and free money movement to loved ones anywhere in the world. The platform allows customers to more easily pay bills, allow direct mortgage and loan deductions directly from their account. The technology allows customers more control, more security, less cost and higher quality account services without high fees, all adding up to more time to enjoy the important things in life.

Dave Dowrich

Dave Dowrich is Senior Executive Vice President and Chief Financial

Officer of TIAA, where he has responsibility for TIAA’s financial

management and planning, actuarial, tax, accounting and financial

reporting functions for the organization.

Dave joined TIAA from Prudential where he held a similar role for

Prudential Financial’s International Businesses, based in Tokyo, Japan.

Prior to Prudential, he worked at AIG as Chief Executive Officer,

International Life and Retirement, with oversight of AIG Life (UK), Laya

Healthcare (Ireland) and leading the Life and Retirement division’s

international strategy and growth. He previously served as CFO of AIG

Japan and Asia Pacific and as CFO and Chief Financial Actuary of

Institutional Markets in the USA. Prior to joining AIG, Dave held senior

roles in investment banking at Goldman Sachs and Credit Suisse, as

well as reinsurance and transaction structuring roles at Swiss Re and

Canada Life Reinsurance. Dave began his career as a pension

consulting actuary in Toronto, Ontario.

Dave earned an MBA in Finance from the Wharton School of the

University of Pennsylvania and a BSc in Actuarial Science and Applied

Statistics from the University of Toronto. He is a Fellow of the Society of

Actuaries, an Associate of the Canadian Institute of Actuaries and a

Member of the American Academy of Actuaries. Dave is on the board of

Scotiabank, Vantage Group Holdings Ltd, has served on several

insurance and non-insurance operating and holding company boards,

and currently serves on the boards of non-profit and academic

organizations.

In July 2022, Dave was named one of the “2022 Most Influential Black

Executives in Corporate America”

(http://savoynetwork.com/features/dave-dowrich/).

Siddharth Durbha

Siddharth Durbha is a Director with the Digital Trust team at KPMG in India and leads DLT & Web 3 security. He has about 13 years of consulting experience covering Asset Liability Management, Technology & Operational Risk management. He has assisted multiple central banks and financial services companies across the world in the digital transformation and security of payment systems, capital markets and risk management systems. He is also an active contributor to ISO TC307 committee involved in drafting security standards for DLT based systems.

Pascale Elie

Pascale Elie, is Chairwoman of CELLPAY.

She has a degree in Actuarial Mathematics and Economy from University of Montreal in Canada.

For many years she successfully managed and lead a top-rated Insurance Company. Later she profound her knowledge and gain experience as CEO of a Visa Credit Card issuer.

Wanting to start her own financial institution she cofounded HaitiPay the first Fintech led of mobile banking service in Haiti. With her team she worked tirelessly to develop a mobile money network of merchants and agents. This earned her the Digicel Entrepreneur of the Year 2014 award in the innovation category.

Alison Browne – Ellis

Alison Browne-Ellis is an experienced Corporate Executive with over 24 years of expertise. In her capacity, she leads a dynamic team and sets strategy for Cave Shepherd Card (Barbados) Inc. t/a as “Payce Digital”. Alison has successfully led her company to acquire the status of the first Non-Financial Institution in the English-speaking Latin American Caribbean region to obtain a Principal Membership license with Visa International while spearheading the launch of one of Barbados’s first digital payment wallets that is available to small business customers and supports the Government’s EZ Pay+ payment platform.

Prior to her current role as CEO, Alison spent 13 years at FirstCaribbean International Bank. She has a proven track record in leading change initiatives in the payments industry with expertise in implementation of innovative products, business development, marketing, credit and customer experience strategies.

Alison holds an Executive Diploma from the Ivey Business School, Western University and a MBA with Distinction, from the University of Surrey. Alison is also a Certified John Maxwell Team Coach. She is a past Vice President and Council Member of the Barbados Chamber of Commerce and Industry where she Chairs the Marketing & Communications Committee.

Alison is passionate about the professional development of our future leaders which has led to the recent launch of her book – “LIFE LESSONS A Purpose Driven Leadership Journey” and her new 365 Day Inspirational Desk Calendar.

Alison is also the Founder of Boss Ladies United – a professional development and networking association for women.

Daphne Ewing-Chow

Daphne Ewing-Chow is an award-winning Caribbean journalist, renowned for her extensive contribution to global discourse on food systems and the environment. She has graced international stages as a moderator and speaker, interviewing country leaders, dignitaries, and celebrities, and holds a Master’s Degree in International Economic Policy from Columbia University.

As a Senior Contributor at Forbes, focusing on food and sustainability, Daphne’s perspectives have resonated strongly with global and regional audiences. Her work, showcased in publications such as The New York Times, The Sunday Times (London), Entrepreneur Magazine, and the International Monetary Fund’s Finance & Development Magazine, underscores her influence in shaping discussions on critical issues pertaining to climate change and food security.

As a strategic communications specialist, Daphne has managed communications initiatives for NGOs and UN agencies, and currently serves as a Communications Specialist at the World Food Programme. She has been a judge for the Zayed Sustainability Prize for the past four years and judged the Rockefeller Foundation’s prestigious Food Systems Vision Prize.

Daphne’s work has been recognized with awards from the United Nations, the Pan American Health Organization, the Caribbean Development Bank, and the Caribbean Broadcasting Union, among others.

Mervyn Eyre

Mervyn Eyre serves as head of Fujitsu’s operations in the Caribbean, where he is responsible for managing the strategic direction and general management of its business in this region. In 2022 and 2023 he also assumed Head the International Business Strategy Office (IBSO), a Headquarters function responsible for enabling Fujitsu’s strategy in Asia Pacific, Europe and the Americas. For two years (2017 – 2019) Mervyn served in an interim role as Head of Managed Infrastructure Services (MIS) for the Americas, where he was instrumental in leading the successful transition of its operations into a Digital Services business, including engagement of Fujitsu’s largest customers in North America. Leveraging more than 25 years of experience in the global ICT industry, Mervyn has been instrumental in leading the introduction of managed and cloud-based digital services in the Caribbean region, opening up new, agile, pay-as-you-use consumption models to the enterprise and government. He is focused on driving growth by adding value through a human-centric, co-creative approach to transforming business operating models, customer experiences and employee well-being. Mervyn is driven by a quest for continuous learning and a passion for technology innovation to enable Fujitsu’s purpose of driving sustainability transformation for both businesses and society.

Moad Fahmi

As Chief Digital Asset Officer (Financial Technology) at the Bermuda Monetary Authority, Mr. Fahmi leads the team responsible for regulatory authorization and supervision efforts under the Digital Asset Business Act 2018. Mr. Fahmi’s team is also responsible for instigating and advancing FinTech innovation, as well as developing the digital asset regime in Bermuda, one of the world’s first jurisdictions with a regulatory framework for digital assets.

Prior to joining the Authority in August 2018, Mr. Fahmi was Director – Fintech and Innovation at the Authority of Financial Markets (Autorité des Marchés Financiers (AMF)), the regulator of the financial services sector in Quebec, Canada.

Marwan Forzley

Marwan Forzley is an innovator and a visionary who’s passionate about building companies through disruptive technologies and global strategies. After founding and selling eBillme, Marwan became the GM of eCommerce and Strategic Partnerships at Western Union.

Marwan is now the co-founder and CEO of Veem, an organization which helps businesses transfer money domestically and internationally. Trusted by over 800,000 users all around the globe, Veem is transforming how businesses pay and get paid with time-saving Accounts Payable and Accounts Receivable automations, and flexible payment options in over 100 countries and 70+ currencies.

Tara Frater

Ms. Tara Frater is the Principal and Founder of FT Legal, a boutique law firm based in Barbados. She is an experienced attorney-at-law with over 15 years of experience working at leading firms in international financial services centres in the Caribbean. She has lectured in various fora on legal issues and her speaking engagements include various Caribbean and Latin American conferences hosted by STEP and other organisations.

Ms. Frater actively engages on issues affecting the international financial services sector in the Caribbean. She participates in various working groups focused on legislative reform and currently serves on the Trust Review Committee and the FinTech Advisory Committee convened by the Barbados Government. She formerly served as the Chairperson of the STEP Barbados Branch and is a former Director of the Barbados International Business Association. She has repeatedly made the Citywealth IFC Power Women Top 200 List, which recognise women of influence in government, private wealth, private client advisory and philanthropy across international financial centres. She has a keen interest in cryptocurrencies and the transformative potential of blockchain technology

Sebastián Castro Galnares

Sebastian is an Ecuadorian entrepreneur. He is the co-founder of Kushki, a leading payments infrastructure company for Latin America founded in 2017 and with a recent entry into the Latin American unicorn club. He also serves as General Partner of Alpha4 Ventures.

In the past, he co-founded Leaf, a technology company dedicated to financial services based in Cambridge, MA. Leaf was acquired in 2014 by Heartland Payment Systems (now Global Payments NYSE: GPN).

Mr. Castro is particularly interested in promoting Latin American tech companies and entrepreneurs and has invested in the region both through his fund as well as an angel investor. He holds bachelor’s and master’s degrees from MIT, where he studied mathematics and engineering.

About Kushki:

Kushki, the world-class payment platform that connects Latin America through payments, helps businesses reduce the cost and complexity of payments online while improving acceptance rates and reducing fraud. With less than a decade of existence. Kushki operates locally in 5 countries and leverages local teams to deliver customized solutions for clients in each country.

Eldred F. Garcia

Eldred F Garcia is the SVP of Business and Partner Development at First Atlantic Commerce & PowerTranz.

He brings 25+ years of experience in the payments industry through banking, consulting, the major credit card brands, processors, 3rd party vendors, and on the merchant side as well. Eldred’s focus has been primarily on the payments industry and, more specifically, on emerging technologies and fraud prevention.

While at Visa, Eldred was responsible for cardholder authentication in e-commerce for Latin America and the Caribbean region. Eldred also directed the Latin America and Caribbean region for TowerGroup, a research and consulting firm in Boston owned by MasterCard, Accertify, a fraud prevention company owned by American Express, and EPX, an international payments processor.

On the merchant side, Eldred owned and operated a restaurant & entertainment establishment where he launched the first “Hot Zone” in partnership with the local city and a fortune 500 telecommunications company. Eldred served in the City of Miami’s Technology Advisory Board and with the United States Secret Service MECTF and ADFIN Groups and was head of the EMV Readiness Committee.

Eldred holds a BA in International Business and Management from FIU and an MBA with a concentration in Marketing from Barry University.

Alfonso García Mora

Alfonso García Mora is IFC’s Vice President for Europe, Latin America and the Caribbean. He spearheads IFC’s engagements in the two regions, including operationalizing IFC’s response to Russia’s invasion of Ukraine and the post-COVID-19 recovery, building a strong pipeline for private sector investments rooted in country strategies, and fostering more collaboration opportunities with key stakeholders to maximize impact.

Mr. García Mora, a Spanish national, brings over twenty years of experience in financial and private sector development, with twelve years in the private sector and nine years in different positions at the World Bank Group. Most recently, Mr. García Mora was IFC’s Regional Vice President for Asia and the Pacific. Before that, he was a Director at the World Bank in charge of different regions (including Europe and Latin America) and global units in the Equitable Growth, Finance, and Institutions Practice Group, including as Global Director of Finance, Competitiveness and Innovation. His experience working across regions and institutions has enabled Mr. Garcia Mora to further foster World Bank Group collaboration and opportunities.

Before joining the World Bank, Mr. García Mora was a Partner and Managing Director in Analistas Financieros Internacionales (AFI), mostly focused on Europe and LAC. In that capacity, he gained extensive experience working with the private sector, regulators, governments, and development finance institutions in different countries.

Mr. García Mora has a PhD in Financial Economics from Universidad Autonoma de Madrid, Spain and has also lectured and published extensively on banking and financial-sector issues.

Nicky Gomez

Nicky is the Senior Partner at XReg Consulting, a boutique public policy and regulatory affairs consultancy specializing in cryptoassets. A former regulator with 15 years of experience in the crypto and financial services industries, Nicky leads the development of XReg’s presence in the Americas, with a strategic focus on Latin America, the Caribbean and North America.

Since founding XReg, Nicky has supported governments and international public bodies with the development and implementation of risk-based, outcomes-oriented crypto-asset regulatory frameworks and strategies that mitigate risk and leverage smart innovation.

He also provides strategic regulatory advice to some of the largest crypto businesses in the world and has successfully secured licenses and authorizations for clients in Europe, Gibraltar, the Caribbean and Asia. As the co-chair of the Global Digital Finance (GDF) AML working group, he helps shape global crypto-asset regulatory standards that mitigate risk and encourage innovation.

Helen Gradstein

Ms. Helen Gradstein is the Regional Representative & Digital Finance Technical Specialist covering the Eastern Caribbean for the UNCDF, based in Port of Spain, Trinidad and Tobago.

She is an expert in digital finance and financial inclusion and is passionate about ensuring that financial inclusion policies and programmes protect consumers, empower women, and support financial capability.

Previously, Ms. Gradstein worked as a Financial Sector Specialist in the World Bank’s Financial Inclusion and Payments team.

She holds a Masters in Global Policy from the University of Texas at Austin, and a Bachelor of Science in Mathematics from the University of California, Santa Barbara.

David Griffiths

Dave is an Associate Partner within IBM Consulting Enterprise Sustainability Practice, specializing in the Financial Services Sector. With over 23-years experience in banking and financial services, Dave focuses on the intersection of business and technology. An Industrial Engineer by training, Dave has a MBA from the Schulich School of Business where he specialized in International Business Strategy and Marketing.

He is a Business Transformation Leader who has designed and implemented large complex programs to drive revenue and capture efficiencies across the entire organization. He identifies opportunities to stop, re-size and re-engineer business activities (demand side), major capability areas (supply side) and business enablers (governance, organization).

Known as The Glue | The Advisor | The Coach | The Impact Investing Connector | The “Get It Done Guy” | | The Care Leader | The Mental Health Advocate, Dave has a reputation as a self-starter. Prior to IBM, he held leadership roles with RBC Bank, D+H, Symcor, Nortel Networks, General Motors and Ford. A passionate philanthropist, Dave is also Founder & CEO of the non-profit Brothers Who Care. He currently leads Social Sustainability initiatives focused on Financial Security, Skills & Education, and Mental Health and Well-being in the Non-Profit sector.

Mario Griffiths

Mario holds a BSc in Business Administration majoring in Finance at the Northern Caribbean University and an MBA in Banking and Finance from the University of the West Indies, Jamaica. He is charged with responsibilities for policy formulation, development and implementation of financial market infrastructures (FMIs) and financial technology for the enhancement of the National Payment ecosystem, development of industry strategies and regulatory policies, guidance around technology innovation affecting the National Payments, Clearing and Settlement systems, managing the development, review and improvement of the Bank’s regulatory framework, systemically important infrastructures and financial innovation (Fintech) to ensure a robust and dynamic regime which satisfies international and regulatory requirements and ultimately mitigates systemic risk, and providing advice and contributing to the development of global and regional standards on Fintech. Currently, he is the Technical Expert providing support and technical advice on the implementation of the CBDC Pilot project. He also represents the Payment System and Money Services Oversight Division on several committees and working groups in the area of Fintech, Fast Payments, Bigtech, Cryptocurrencies, CBDC and Financial System Stability. In 2016, he was seconded to the Bank for International Settlements (BIS) where he was assigned to the Monetary and Economic Department, Committee on Payments and Market Infrastructure (CPMI).

Bank of Jamaica (BOJ) is the Central Bank of Jamaica. The BOJ is responsible to formulate and implement monetary and regulatory policies to safeguard the value of the domestic currency and to ensure the soundness and development of the financial system.

Aaron Grinhaus

Aaron Grinhaus LL.B., J.D., LL.M. (Tax) is a business and tax lawyer, writer and lecturer, and the founder of Grinhaus Law Firm (grinhauslaw.ca) based in Toronto, Canada. Aaron advises on business, international tax, estate structuring and regulatory matters, and is an established Web3 and Fintech consultant.

Aaron has acted as chair, presenter and lecturer through a number of educational institutions and organizations. He is Faculty and Co-Director of Osgoode Hall Law School’s prestigious Web3, Blockchain and Metaverse Law Certificate Program and in 2019 he published “A Practical Guide to Blockchain and Smart Contract Law” (LexisNexis), the world’s first textbook on Blockchain and Smart contract law now in its third edition with international editions. In January 2022 Grinhaus Law Firm became the first Canadian law firm (and one of only a few in the world) to establish an office in the Metaverse. He was also a founding member of the Metaverse Bar Association (MetBA.io).

Aaron holds law degrees from the University of Ottawa (LL.B.), Michigan State University College of Law (J.D.) and a Masters in Tax Law from Osgoode Hall Law School of York University (LL.M.)

Carol Grunberg

Carol spearheads global payments, partnerships and commerce innovation, holding executive roles at Citi, Northwestern Mutual, Ant Group, and Google. Integral in developing super apps and unified commerce, she excels in emerging markets and the US-Asia tech sector.

Driven by a passion for fintech and social impact, Carol leads advancements in AI, commerce, and payment technologies. She is a vocal advocate for women in business and dedicates herself to community development. As a TeamUnity board member, Carol focuses on enhancing social health factors in Harlem, NY.

Martin Hanna

Martin Hanna is a renowned fintech and retail entrepreneur who has made a significant impact in the business world. As the CEO and Founder of Penny Pinch Inc., he has demonstrated a remarkable ability to build innovative products and systems that provide immense value to users.

Martin’s passion for design, product development, and marketing has enabled him to create solutions that are both aesthetically pleasing and functionally effective. He has a keen eye for identifying gaps in the market and developing products that fill those gaps, making life more convenient for people in the process.

Despite dropping out of college, Martin’s entrepreneurial spirit and determination have driven him to become a successful business leader. He has won several awards for his innovative ideas and has been recognized as a thought leader in the fintech and retail space.

Aside from running Penny Pinch Inc.,a regulated money services business (MSB) that offers a mobile-first alternative to money management and spending, Martin is committed to helping other entrepreneurs succeed. He has a talent for guiding new business owners through the challenges of building and growing their businesses. His expertise and mentorship have helped many young entrepreneurs to achieve their goals and realize their dreams.

Martin’s dedication to innovation, creativity, and helping others has made him a standout figure in the business world. He continues to inspire and motivate people through his work, and his impact on the fintech and retail industries is sure to endure for years to come.

Zachary Harding

Zachary Harding is the Executive Chairman and co-founder of Delta Capital Partners, a Caribbean based Private Equity firm. Delta has investments in Financial Services, Health and Wellness, E- commerce, Media and Entertainment, and Industrials and was awarded as “The Next 100 Global Awards – Private Equity Deal House (2021)”.

Natasha Harper-Madison

Natasha Harper-Madison is a seasoned member of the Austin City Council, representing the 10th largest city in the U.S., Austin, Texas, for a second term. With six years of experience, she is a champion for addressing Austin’s housing crisis and navigating economic opportunities in a city marked by economic segregation.

Harper-Madison’s leadership stands out in a city on the cusp of innovative revitalization, despite being behind in infrastructure. She excels in balancing pragmatic policy-making, cutting-edge technology, and community-driven growth. As a Community Revitalization Specialist, she actively works towards breaking the cycle of poverty.

In addition to her political role, Harper-Madison is the founder of CivSop, a civic education and workforce development initiative. Her entrepreneurial endeavors and commitment to civic education showcase her forward-thinking approach.

As a sought-after speaker, Harper-Madison inspires others to engage in shaping a more vibrant and equitable future for Austin. Her multifaceted contributions make her a transformative force in the city’s growth and development.

Jason Hayward

The Hon. Jason Hayward JP, MP currently serves as the Minister of Economy and Labour in the Bermuda Government. In this role, he is primarily responsible for the economic growth, development and the expansion of jobs in Bermuda. His portfolio oversees the island’s immigration, workforce development, labour relations, financial assistance, international business, statistics and economic development.

Minister Hayward was first elected as a Member of Parliament in 2019, and was later appointed as the Minister of Labour in 2020. Before becoming a Member of Parliament, he was appointed to the Bermuda Government Senate in 2017, and served as Junior Minister of Education, Health, Labour, Community Affairs and Sports. Mr. Hayward is a former Chairman of the National Training Board and chaired the Working Group which produced Bermuda’s first National Workforce Development Plan.

Prior to entering the political arena, Min. Hayward worked in the Economic and National Accounts Division of the Department of Statistics. Min. Hayward also served as the first elected full-time President of the Bermuda Public Services Union (BPSU), President of the Bermuda Trade Union Congress, and Director and Treasurer of the Bermuda Credit Union.

Min. Hayward is an alumnus of the Canada – Caribbean Emerging Leaders Dialogue (a Commonwealth leadership development program), an alumnus of the US Department of States’ International Visitor Leadership Program, and holds a Chartered Manager Designation from the Chartered Management Institute.

Minister Hayward holds a MBA in Finance from Nova Southeastern University, a Bachelor’s degree in Business Administration from Mount Saint Vincent University and an Associate’s degree in Arts and Science from the Bermuda College

Peter Hazlehurst

Peter Hazlehurst, CEO and co-founder of Synctera, is a global FinTech entrepreneur and philanthropist with nearly 30 years of experience creating financial products for banks, FinTechs, and large tech companies.

In 1993 he built core banking technology for Phoenix, which still powers companies today. More recently, Peter served as Head of Uber Money, Chief Operating Officer at Postmates, Senior Director of Product Management at Google, CEO and Board Member of Google Payments Corporation, and Chief Product Officer at Yodlee.

Peter also led Product at Nokia for Enterprise Mobility and Mobile email and has served as a CTO and consultant at several startups.

Roger Hennis

Roger is the CEO of Avvant – an advisory firm focused on strategy, innovation and digital transformation. Avvant works, in conjunction with its global network, to support private sector clients and governments in the Caribbean region and Africa. Roger also works as an independent consultant supporting the work of multilateral agencies, such as the United Nations Development Program (UNDP) and the Organisation of the American States (OAS).

Roger has driven advisory services in organisations such as IBM, Fujitsu and most recently, Deloitte. An experienced digital transformation expert, Roger has led development of the Government Digital Strategy for both the St. Kitts & Nevis and Barbados governments.

When not working with commercial clients, Roger works tirelessly support the development of innovation and entrepreneurship. He has worked in an advisory capacity with TEN Habitat (Barbados) and mentorship capacity with the Branson Centre of Entrepreneurship (Jamaica).

Garnet Heraman

Garnet Heraman is a serial entrepreneur and fund manager with over 20 years experience at the intersection of innovation, diversity + technology. Garnet’s family emigrated to the US from Trinidad & Tobago, and he was educated at Columbia University, NYU and The London School of Economics. As an entrepreneur, he built 3 startups, had 2 exits one of which was to a publicly traded company. As an investor, Garnet has helped build 2 investment platforms, the most recent being Aperture Venture Capital, VC For The Multicultural Mainstream™.

Garnet’s investment experience with AI goes back to the early 2000’s when his second company – University Ventures – was engaged in the acquisition of patent portfolios related to NLP, OCR, machine vision, machine learning & decision support systems from a network of 40 research universities across North America.

Garnet lives in Laguna Beach, CA with his wife and one very spoiled rescue dog.

Juan Luis Hernandez

Juan Luis Hernández is a professional with over 12 years of experience in the remittances business. He has a proven track record of creating and implementing innovative products aimed at simplifying and enhancing the accessibility of remittance services.

Currently serving as the Regional Business Development Manager at TerraPay, Juan Luis is instrumental in driving the company’s expansion efforts in Latin America and the Caribbean.

Before his role at TerraPay, Juan Luis held positions in Banco Azteca, Millicom (Tigo), and Banco G&T Continental, where he honed his skills in market analysis, strategic planning, and international business development.

Daryl Holman Jr.

Daryl is first and foremost a fanatic older brother who always comes equipped with a story about his latest adventure. Affectionately described by others as “someone you want on your team when sh** hits the fan”, Daryl brings that same intensity to the strategy and vision for Revival, where borrowers can buy out and eliminate their debt for the discounted rates it gets traded for on the aftermarket.

Prior to starting Revival, Daryl designed the websites for two of the leading organizations in the fight to cancel student debt and served as a US Senate panelist on the issue. Outside of work, Daryl is a marathoner, a novice sailor and that person who will facetime an old friend without any warning.

More than anything, Daryl cares about access to opportunity and regularly volunteers and donates to organizations focused on helping people create a better life for themselves.

Dwight Housend

Dwight Housend is a Co-Founder and The Executive Chairman of TT RideShare Ltd, Trinidad & Tobago’s largest ridesharing company. He has over 12 years of experience in Banking and Finance in Trinidad and has utilized his expertise and knowledge of Information Systems to guide and expand the ridesharing market in T&T.

Dwight’s guiding philosophy as a young professional is that, in the Digital Era, technology solutions should be utilized in process development, strategic planning, and structural and change management. He has led with a focus on people analytics, enforced by his view that many organizations often overlook psycho-social factors as they utilize new technologies to pursue digital transformation. He has strong values of integrity, respect, responsibility, and family.

Krystal Hoyte

Zlata Huddleston

Zlata Huddleston

Tracy-Ann Hyman

ARTEL uses artificial intelligence-based (A.I.) solutions, to solve the globe’s disaster management challenges. Our Company develops Information and Communication Technologies (ICTs) that save lives and protect property from man-made and natural disasters. The aim is to dramatically improve the decision-making capabilities of our clients, through risk management, monitoring and evaluation. This is for Climate Change Adaptation, Resilience and the impact hazards have on our clients’ bottom line, across Latin America and the Caribbean. Our AI, climate-driven solutions therefore target Disaster Agencies, Multi-lateral agencies, Development Banks, Insurance Companies, Financial Institutions and Local Government Council, among others.

R. Paul Inniss

Paul is a successful and results driven insurance executive, with extensive knowledge and experience in leading high-performance teams in the insurance and banking sectors across multiple Caribbean jurisdictions. He has proven successes in implementing and executing business strategies for large regional financial institutions.

HIGHLIGHTS OF CAREER LEADERSHIP POSITIONS

- Executive Vice President & General Manager – Sagicor Life Inc – Barbados Operations

- SVP, Barbados Chamber of Commerce & Industry

- Director, Insurance Association Caribbean

- Director, Insurance – CIBC FirstCaribbean International Bank

- Chief Operating Officer – Island Heritage Insurance Company

- General Manager for Barbados & Eastern Caribbean Islands with Pan American Life Insurance Group

- Past President – General Insurance Association of Barbados (GIAB) PROFESSIONAL

EDUCATION / DEVELOPMENT

- MBA – Edinburgh Business School, Heriot-Watt University, Scotland